In July of 1954, Donald Trump’s father was subpoenaed by the U.S. Senate Banking Committee. At the time, the Senators were conducting an investigation into fraud at the Federal Housing Administration. Fred Trump’s testimony to the committee is so shocking and weird that we recommend reading it in full, for yourself. (It starts at about page 400 of this pdf, but we have transcribed Trump’s testimony in full at the bottom of this post.) We’re going to give you an executive summary, however.

At the time this testimony was delivered, Donald J. Trump was only eight years old. We believe that this testimony is nevertheless relevant to understanding Donald J. Trump. President Trump inherited his father’s business, including it’s shadiest practices.

- Fred Trump used government-financed loans to obtain 100% ownership of an asset with a 0% personal investment. This was one of the key points at issue in Trump’s testimony. On a $16 million project, Fred Trump made a small investment that was reimbursed by funds from a government-insured mortgage. When pressed near the end whether Trump would have built the Beach Haven Apartments if the government had required him to contribute 10% of the equity, his answer was “no.”

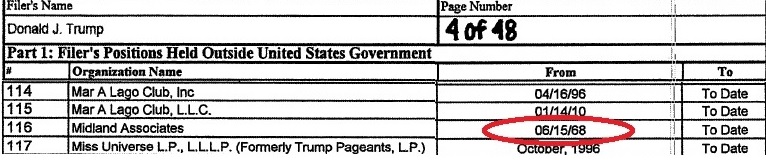

- Donald Trump became a land owner at the tender age of three. Fred Trump created a trust for his children related to this deal in 1949. Donald J. Trump was born in 1946. Donald and his siblings owned the ground on which the government-subsidized buildings sat. The buildings signed a 99 year lease guaranteeing they would pay the Trump children $60,000 per year in rent.

- The deal was nothing but upside for Trump, with all the risk falling on the lender. By turning title of the land under the buildings over to Donald and his siblings, Fred Trump created a situation where there was no risk to the Trumps. As the Senators noted, if the government tried to foreclose on the mortgages, it would be required to either assume responsibility for the lease and pay the Trump children $60,000 a year in rent for the rest of the century or pay them $1.5 million up front to buy the lease out.

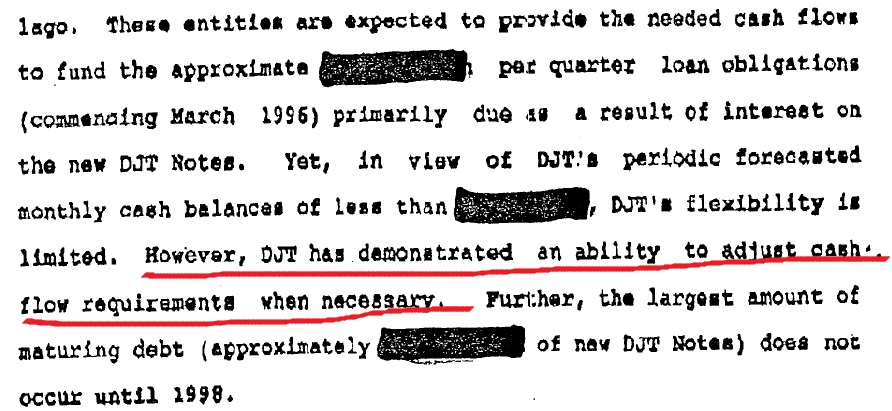

- Fred Trump borrowed more than he needed and treated the loan proceeds as if they were income. The Beach Haven project ultimately cost $12 million to construct. But Fred Trump borrowed $16 million to build it. This left Trump in control of a $4 million slush fund that he diverted for his own purposes.

- Fred Trump padded the expenses and paid himself out of the excess borrowing. When Fred Trump applied for his FHA mortgage, he projected that 5% of the project cost would go to builders’ fees and another 5% would go to architects’ fees. Since Trump also owned the building, paying himself a builder’s fee to construct it was likened by one Senator to paying yourself to mow your own lawn. Actual architect fees were less than 1% of the total project cost, but Trump explained to the Senators that he paid himself the remaining amount to reflect the cost of supervising his architect. (Yes, Fred argued with a straight face that he had to pay himself at least $4 for every $1 he paid his architect to cover the costs of watching the man work.)

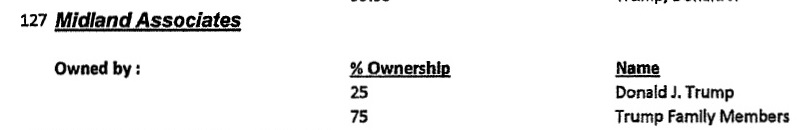

- The buildings were owned by a web of corporations all under Fred Trump’s control. This is going to be a critical point to understand as we try to explain the structure of Donald J. Trump’s financial empire. For this one particular project, Fred Trump created six shell corporations, all of which he entirely owned and controlled. These corporations are the way that the Trump family passes money and debts around, even to this day.

Complete Testimony

The Chairman: The committee will please come to order. our first witness will be Mr. Trump. Will you please come foreward, Mr. Trump. Will you be sworn, please? Do you solemnly swear that the testimony you are about to give will be the truth, the whole truth and nothing but the truth, so help you God?

Mr. Trump: I do.

The Chairman: Thank you, sir. You may be seated. Now if you will give your name and address to the reporter, we will appreciate it very much.

Mr. Trump: Trump, T-r-u-m-p, Fred C. Business address, 8931 161st Street, Jamaica.

The Chairman: Then you are the attorney?

Mr. Judd: Yes sir, both of us. I am Mr. Orren G. Judd, 655 Madison Avenue, New York City, attorney for Mr. Trump.

Mr. Tosti: I am Mathew J. Tosti, 8931, 161st STreet, Jamaica, N.Y., general counsel for Mr. Trump.

Mr. Simon: Mr. Judd, we would like to ask you some questions about the Bond Haven Apartments project.

Mr. Judd: Mr. Simon, if I may make a statement at this time, we have a statement prepared which outlines the facts that I think are material and if we can proceed with that and you ask any additional questions about it.

The Chairman: We will be very happy to have you place in the record your statement when we get through asking the questions.

Mr. Judd: If we could present the statement orally.

The Chairman: In answer to the specific questions you can use that portion of the statement which answers them and then when we are through today we will be very happy to have you put the full statement in the record.

Mr. Simon: Mr. Trump, who is the owner of the land on which the Bond Haven Apartments project is located?

Mr. Trump: It is the Beach Haven Apartments, in Brooklyn.

Mr. Simon: Excuse me.

Mr. Trump: William Walter and the Bank of Manhattan & Co. as trustee.

Mr. Simon: They are the trustees for whom?

Mr. Trump: Members of my family.

Mr. Simon: Did you place the land in trust?

Mr. Trump: Yes.

Mr. Simon: When did you first acquire the land?

Mr. Trump: About 10 years ago. In 1944.

Mr. Simon: What did you pay for it?

Mr. Trump: I have here, in view of the fact the land-cost question came up at our last meeting, I prepared a one-paragraph statement here.

Mr. Simon: Could you just tell us what you paid for it?

Mr. Trump: It wouldn’t tell the right story. There have been a lot of stories in the newspaper about what we did pay for it, which were not so.

The Chairman: What did you pay for it?

Mr. Trump: We paid approximately $200,000 for the land.

Mr. Simon: From whom did you buy the land?

Mr. Trump: We bought it from, I believe, three different owners.

Mr. Simon: Who are the three owners?

Mr. Trump: One would be Brooklyn Development Corp. One I believe is the Bronx Realty and the third I don’t remember – and the City of New York, also.

Mr. Simon: How much of the land did you buy from the Brooklyn Realty Co.?

Mr. Trump: The Brooklyn Realty Co., we bought, subject to probably 5 or 8 to 10 years’ back taxes, back assessments and penalties –

Mr. Simon: How much?

Mr. Trump: They had owned the land since 1891.

Mr. Simon: How much did you buy from them and how much did you pay them for it?

Mr. Trump: In area, I don’t know. We paid them, I would say – what did the land cost? Do we have a breakdown here? Brooklyn Development, we purchased a part of the land from Brooklyn Development Corp. We bought that subject to all penalties, bad title, and everything. They wanted $34,500 for a deed, and they were not interested in what the penalties were and what the back taxes were, as they had owned it since 1891.

Mr. Simon: How much did you pay the Bronx Co.?

Mr. Judd: I think he was going on with what the amount of the taxes were and other items in connection with it.

Mr. Simon: I want to know what he paid for it and then what the taxes were.

Mr. Trump: You want to know what I paid Brooklyn Development?

Mr. Simon: That is right.

Mr. Trump: We paid the City of New York $44,000 in taxes on the original piece, which were back taxes.

Mr. Simon: How much did you pay the prior owner of the land for the land?

Mr. Trump: That is what we paid; $44,000 in back taxes.

The Chairman: You didn’t pay the prior owner anything; you just bought it for the unpaid taxes?

Mr. Trump: We gave them $34,000 for a deed, subject to bad title, subject to 4 or 8 or 10 years back taxes, assessments and penalties. They were about to lose it to the city of New York, I believe, on tax lien sales.

Mr. Simon: You said you bought this in three tracts, is that right?

Mr. Trump: Yes.

Mr. Simon: The first tract you bought from this Brooklyn Co.?

Mr. Trump: That is right.

Mr. Simon: The second tract you bought from the Bronx Realty Co.?

Mr. Trump: Yes.

Mr. Simon: How much did you pay Bronx Realty?

Mr. Trump: Bronx Realty also had had title land in the bed of a creek and we paid – it says $59,000 but I think we paid them $75,000.

The Chairman: $75,000?

Mr. Trump: Yes.

Mr. Judd: $75,000 includes what you paid the City of New York.

Mr. Trump: I see; $75,000 total for the particular land covered by the Bronx Realty contract.

The Chairman: From who did you the third tract?

Mr. Trump: The City of New York.

The Chairman: What did you pay for that?

Mr. Trump: There were clouds on the title. They didn’t actually own it. We needed them to join in a deed. We paid them $16,300 plus $3,506.

The Chairman: That totals about $180,000 for the land and taxes, is that right?

Mr. Trump: I think it is less than that, but we have a few other items here that you don’t have here. We paid a broker’s commission on the deal of $5,000 in January 1945. We had a title bill of $767, a surveyor’s bill of $750, and this sheet here – well, it is about $185,000 without taxes from 1944 to the date we started building on there in 1950.

Mr. Simon: You bought the land in 1944, didn’t you?

Mr. Trump: We bought some of it in 1944.

Mr. Simon: You paid approximately $180,000 for the land and the taxes that were then delinquent; is that right?

Mr. Trump: I would say about that, that is right, that is what this sheet says.

Mr. Simon: When did you give the property to your children?

Mr. Trump: August 10, 1949.

Mr. Simon: Did you file a gift-tax return on the gift?

Mr. Trump: Yes, we did.

Mr. Simon: And what value did you place on the land for the gift-tax purposes?

Mr. Trump: At the time we placed a value, when we bought this entire parcel, some 10 years ago-

Mr. Simon: What was the value you placed on it in 1949 for the gift-tax return?

Mr. Trump: In 1949, the assessed value of the entire parcel.

Mr. Simon: What is the value placed on it in your gift-tax return?

Mr. Trump: We placed a value of $180,000 in the gift-tax return which was a little more than the assessed valuation of the land.

Mr. Simon: Did the Treasury accept that valuation?

Mr. Trump: No they didn’t accept it.

Mr. Simon: At what valuation did you ultimately settle with the Treasury?

Mr. Trump: $260,000.

Mr. Simon: When did you reach that settlement with the Treasury?

Mr. Trump: October 1952.

Mr. Simon: That valuation was made in October 1952, as of August 1949, is that right?

Mr. Trump: Yes.

Mr. Simon: What did FHA value this land at? What was the FHA valuation of the land for your lease purposes?

Mr. Trump: With the completion of the Beach Haven project they valued it as improved land with 60 units built on that. No relation to when we bought raw acreage.

Mr. Simon: Wait a minute. The land is owned by this trust, isn’t it?

Mr. Trump: Yes.

Mr. Simon: And the trust has no interest in the building, has it?

Mr. Trump: That is right.

Mr. Simon: The building is owned by Beach Haven Apartments Corp., isn’t it?

Mr. Trump: That is right.

Mr. Simon: And the trust has leased the land for 99 years to the corporations; is that right?

Mr. Trump: Yes, with a renewal for 99 more.

Mr. Simon: And that lease comes ahead of the FHA mortgage, doesn’t it?

Mr. Trump: Yes.

Mr. Simon: Now, for the purpose of fixing a rental on that 99-year lease, FHA put a valuation on the land, didn’t they?

Mr. Judd: If I may interrupt, Mr. Simon, it seems to me the FHA put a recapture provision, which is not the same as putting a value on the land because the rent that they fixed would not give an adequate return on that recapture.

The Chairman: What was the recapture then?

Mr. Trump: The recapture on the 6 parcels – there were 6 corporations there – the recapture totals I believe about $1,500,000.

The Chairman: They put a value of $1,500,000 on that which cost you $180,000 upon which you paid gift tax on a valuation of $260,000.

Mr. Trump: Only if we build 1,860 apartment units. If we don’t we don’t get a dime.

Mr. Chairman: Then, this trust arrangement that you set up for your children rented the land to the corporation that owned the building for how much a yar?

Mr. Trump: For exactly the rent set up by the FHA.

The Chairman: How much was that?

Mr. Trump: $60,000 a year.

The Chairman: In other words, they rented it for $60,000 a year for 99 years?

Mr. Trump: That is right.

The Chairman: With the right to renew for another 99 years?

Mr. Trump: Yes.

The Chairman: So if FHA has to repossess the building, FHA agreed to pay you how much?

Mr. Trump: That is a very “iffy” question. We have already paid $1 million off on the FHA mortgage.

The Chairman: My point is, if FHA has to repossess the building do you enter into a contract with FHA that they would pay you X amount of money?

Mr. Judd: The question implies that FHA agreed to buy it. I understand FHA had a right to buy it.

Mr. Simon: The Senator didn’t say that. If FHA exercises its option to buy it, what do they have to pay for it?

The Chairman: Let me put it the other way around. If FHA has to come in and repossess the buildings on this land, which are now sitting on the land, which you are holding in trust for your children, where they are getting $60,000 a year, for 99 years, if FHA has to repossess the land, how much are they to pay you for the land?

Mr. Trump: That would be the recapture price which I believe totals $1,500,000.

The Chairman: In other words, if FHA must repossess the building they pay the trust you set up $1,500,000.

Mr. Trump: That is right, but the “X” is not there. That is an “iffy” question which will never happen because we have already, in 3 years, paid off the Beach Haven mortgage, close to $1 million.

The Chairman: I understand that. Let me ask you this, then: Why didn’t you turn the land in, as part of the Beach Haven Management Corp.?

Mr. Trump: For a very sound reason, Senator.

The Chairman: Why?

Mr. Trump: If we turned that in and mortgaged the fee, our rooms – where you throw the land in – the room size is much smaller, and with small rooms, the Beach Haven at Brighton project would not be the outstanding project in the city of New York which it is today, because our room size would be too small.

The Chairman: The mortgage includes $1,500,000, does it not, for the value of the land?

Mr. Trump: No, it doesn’t include that, Senator. If we threw the land in, we would have killed the project because our rooms then would be as small as a lot of other projects and we wouldn’t have 100 percent rental as we are today.

Mr. Simon: That certainly isn’t true if you put the land it at anything remotely what you paid for it.

Mr. Trump: What we paid in 1944, Mr. Simon, has no bearing whatsoever on what land is worth. Suppose we paid too much for it?

The Chairman: When did you declare a $260,000 gift tax valuation on it, what year?

Mr. Trump: That was as of –

The Chairman: 1949? Had the project been started at that time?

Mr. Trump: No, no.

The Chairman: When was the project started?

Mr. Trump: In the latter part of 1949.

The Chairman: Did you know you were going to build this project in 1949 when you declared a gift tax of $260,000 on it?

Mr. Trump: We had a project in mind but we never knew it was going to be built. The gift tax was delayed 2 years.

Mr. Simon: Mr. Trump, didn’t you file the application with FHA 6 months before, or several months before the tax valuation?

Mr. Trump: Yes. That is filed with FHA. But many applications expire and the projects are never built. This project never would have been built if I wasn’t able to secure a partner after the gift of the land.

Mr. Simon: But you filed the application on April 29, 1949, is that right?

Mr. Trump: I don’t know. I’ll take that date, yes.

Mr. Simon: It was in April, at any rate, wasn’t it?

Mr. Trump: I see.

Mr. Simon: Isn’t that right?

Mr. Trump: If you have it there. Approximately, yes.

Mr. Simon: I will be glad to show it to you if that refreshes your recollection.

Mr. Trump: Yes.

Mr. Simon: As a matter of fact, if you will look on the reverse side Mr. Trump, you will find it is dated August 10, 1948, a year before the gift. Is that your signature on the back side there?

Mr. Trump: I believe that was for a different project that was never built.

Mr. Simon: It was on the same land though, wasn’t it?

Mr. Trump: We had filed for another project and we didn’t build that project.

Mr. Simon: On the same land?

Mr. Trump: On the same land, that is right. And this gift tax – the deed of trust was drawn a year and a half prior to August 1949, by an attorney who died in the middle of the picture. That is what delayed turning it over to the children.

Mr. Simon: In any event for gift-tax purposes in August 1949, you and the Treasury agreed to a valuation of $260,000, your children get $60,000 a year rent, and if FHA ever wants to recapture the land they have to pay $1,500,000 for it?

Mr. Trump: The trustees, the Bank of Manhattan Co.

Mr. Simon: That is right, isn’t it?

Mr. Trump: Yes. If they recapture. That is if the mortgage is in default. That is the only time they can recapture. That “if” will never happen.

Mr. Simon: What is the cost of Section 1 of this project?

Mr. Trump: That is construction cost, is that the idea?

Mr. Simon: That is right. The construction cost.

Mr. Trump: Could I read Mr. Simon, please –

Mr. Simon: I would be grateful if you tell me what the cost was.

Mr. Trump: A very small statement here on land cost. It is just eight lines. I think it might be misinterpreted, what was said here this afternoon.

The Chairman: We don’t want anything to be misinterpreted, I assure you of that.

Mr. Trump: I am sure you don’t. “Land cost: The question of cost of land is only useful to create misleading newspaper headlines and television and radio stories.” Now, I say that with due respect to this committee. I have no complaint, but this project has been highly publicized as the land costing $34,000 and leasing it to my children at $60,000, but not by this committee. But if the cost of land 10 years ago –

The Chairman: It didn’t cost $34,000, what did it cost?

Mr. Trump: $200,000.

The Chairman: Your complaint that it is not $34,000 but nearly $200,000?

Mr. Trump: Yes.

The Chairman: You have no complaint about the fact that you did lease it for 99 years at $60,000 a year.

Mr. Trump: And no complaint about this committee, Senator. No complaint at all.

Senator Lehman: When you set up the trust for your children, did you turn over the land or did you turn over the contract?

Mr. Trump: Only the land, Senator, was turned over. We had owned the land several years prior to that. “Ten years ago when the bulk of the land was purchased-” oh, I see. The question of land is only used to create misleading headlines. “Ten years ago when the bulk of the land was purchased I might have gotten it for nothing. On the other hand I might have paid $2 million for it. The value of the land today, with the Beach Haven improvement on it would not be altered 10 cents by what I paid for it 10 years ago.”

The Chairman: But the fact still remains that the Federal Government guaranteed 100 percent and more, that building that went on there, that made that land valuable, isn’t that true, too?

Mr. Trump: I wouldn’t say that exactly, Senator.

The Chairman: You wouldn’t? Well who did guarantee the mortgage?

Mr. Trump: Without the guaranteed mortgage, built up, that land would be worth much more today than what the FHA allowed me. Now, I just have three lines. “It is assessed today at approximately $1,350,000 by the city of New York. That is the land. It was assessed when I bought it 10 years ago at approximately $165,000.” It is worth over $1.2 million more.

The Chairman: My big complaint on this is that you should have represented the land as a part and parcel of the corporation that owned the building until FHA’s mortgage was paid off. That is all. I don’t care what you do as a private enterpriser.

Mr. Judd; Isn’t that a complaint against FHA rather than against the builder who was operating under FHA regulations?

The Chairman: It is not a complaint against him, particularly, it is a complaint against FHA, it is a complaint against the whole business.

Mr. Trump: I say here in the last line: “I am proud of this contribution to the city of New York, through my efforts in developing this land to its best use.” In other words, raising the assessed value from $165,000 10 years ago to $1,350,000 today.

Mr. Simon: Mr. Trump, what was the cost of the construction of Section 1?

Mr. Trump: You want actual cost with interest on the advances?

The Chairman: Is there any cost other than actual costs? You have just one set of costs, don’t you?

Mr. Trump: There is a difference, Senator.

Mr. Simon: We want all the money you paid out to anybody to construction Section 1.

The Chairman: When all the bills were paid, what was the total?

Mr. Trump: How about real-estate taxes on the land during construction. Interest on buildings.

The Chairman: You have the figures. Just tell us the total cost after it was all paid.

Mr. Trump: We have here Beach Haven Apartments 1, schedule of construction costs, and it totals $4,015,783.

Mr. Simon: You don’t want to be misunderstood, testifying under oath, that you paid that money out, do you, Mr. Trump?

Mr. Trump: No, I will explain this to you, Mr. Simon.

Mr. Simon: What were your costs?

The Chairman: Your actual costs we want. Not the fees that you didn’t pay such as these architects’ fees and builders’ fees. What did it actually cost you in dollars and cents, please? Give us that, will you please?

Mr. Simon: Did it cost you $3,627,332?

Mr. Trump: I would say roughly $3,627,332, without figuring builders’ fees, which we took ourselves.

Mr. Simon: Did you pay any builders’ fee?

Mr. Trump: We absorbed – we did the work you would ordinarily pay a builders’ fee for and we are entitled to the builders’ fee because the project was built. We performed the service.

Mr. Simon: When you mow your own lawn, does anybody pay you a fee for it?

Mr. Trump: Let me put it this way, Mr. Simon, and I think it will be very clear.

Mr. Simon: I think it is clear. You own the building, is that right?

Mr. Trump: Let me put it this way – I know you don’t want this to be misinterpreted. We have had enough misinterpretation – not by your committee – on this particular project. If I am over cautious, I hope you will bear with me. If a tailor has one of his men make a suit of clothes, that suit will cost X dollars. If the boss tailor makes a suit of clothes, he can’t sell that suit cheaper. That suit is worth just as much as though he paid a man to make the suit.

The Chairman: That may be true, but we are not asking for that.

Mr. Trump: When he sells the suit he will be compensated for his services but the suit is worth exactly what the other suit was worth that he had made. Now, whether we supervised the work ourselves or paid someone to do it we are entitled to the builders’ fee.

The Chairman: I would agree 100 percent with you if you were selling the project but you still own the project. You are working for yourself. You still own it.

Mr. Trump: We might sell it. And then that builders’ fee will be reflected for tax purposes. But until that time, the tailor doesn’t report his suit and we don’t report our builders’ fee.

The Chairman: What was your cost, Mr. Trump, on section?

Mr. Trump: Without builders’ and architects’ fees?

The Chairman: Including everything you paid everybody no matter whom you paid or what it was for.

Mr. Trump: But without builders’ and architects’ fees allowed by FHA regulations.

The Chairman: If you paid them we want it included. If you didn’t pay them we don’t want it included.

Mr. Trump: The only reason we didn’t pay them is because we performed the work ourselves.

The Chairman: We want every cost you paid.

Mr. Trump: The paid-out cost, $3,627,000.

The Chairman: What was the proceeds of the mortgage?

Mr. Trump: The mortgage was $4,140,700.

Mr. Simon: That was the face amount of the mortgage, is that right?

Mr. Trump: Yes.

Mr. Simon: What was the total proceeds of the mortgage?

Mr. Trump: Do you mean the difference between the two?

Mr. Simon: No; the proceeds.

Mr. Trump: Oh, I see, “mortgage premium received: $55,856.”

Mr. Simon: Then, the total proceeds of the mortgage was a little above $4,196,000?

Mr. Trump: Yes, I’d say that, yes. About $4.2 million.

Mr. Simon: What was the cost of section 2?

The Chairman: What is the difference between the cost and the mortgage of Section 1? $600,000?

Mr. Trump: This was before the architects’ fee and the builders’ fee but both are allowed by the FHA regulation.

The Chairman: We understand that just as well as you do. We want to know exactly how much you did pay out in dollars and cents. We know that FHA allowed builders’ fees and architects’ fees, but just exactly how much did you pay out?

Mr. Simon: The difference between the cost of the building and the proceeds of the mortgage is roughly $568,000, is that right?

Mr. Trump: If you included the mortgage premium, Mr. Simon – I believe that should be taken out – that was due to a plentiful money market. It had no bearing on construction cost at all.

Mr. Simon: Mr. Trump, in the figure you have given us of $3,627,000 you include a $53,000 FHA fee, don’t you?

Mr. Trump: Yes. That is an inspection and appraisal fee during construction.

Mr. Simon: And that is also a fee for FHA to insure the mortgage, isn’t it?

Mr. Trump: Well, we call it an FHA appraisal and inspection fee.

Mr. Simon: The only reason you paid FHA a fee was to get their insurance on the mortgage, didn’t you?

Mr. Trump: To get their insurance on the mortgage? I wouldn’t know. They charged a fee and we paid it. What it was for I don’t know.

Mr. SImon: Why did you go to FHA at all, if what you wanted wasn’t their insurance of the mortgage?

Mr. Trump: Conventionally you can’t get a mortgage in the amount that FHA Government-insured will give. The same bank that will take a Government-insured mortgage wouldn’t loan you uninsured.

Mr. Simon: Of course. The reason you went to FHA and the reason you paid them $53,000 was because you wanted an FHA-insured mortgage, is that right?

Mr. Trump: That is a necessary construction cost, like you pay a bricklayer or a carpenter. It is just as necessary.

Mr. Simon: You paid the $53,000 to get their FHA commitment, is that true?

Mr. Trump: Yes, and we included it in construction cost.

Mr. Simon: And because you had an FHA commitment, which meant the United States Government guaranteed the mortgage, you got a premium, is that right?

Mr. Trump: No that doesn’t work that way, Mr. Simon.

Mr. Simon: Do you know of any mortgages in the amount of $15,000,000, conventionally, where the banks gave premiums?

Mr. Trump: Where the banks gave premiums?

Mr. Simon: Yes, on $15,000,000 conventional loans.

Mr. Trump: I wouldn’t know.

Mr. Simon: Do you know of any?

Mr. Trump: No. All I know about is my Beach Haven project. I am not qualified to say.

Mr. Simon: Do you think the banks would have given you a premium if it hadn’t been guaranteed by the United States Government in the case of Beach Haven?

Mr. Trump: That I don’t know.

The Chairman: The answer is “No” and it doesn’t make any difference one way or another.

Mr. Simon: They wouldn’t have made a 90-percent mortgage let alone give you a 4-percent premium.

Mr. Trump: The money market was plentiful at that time. A little later we had to pay a point and a half to get mortgages. FNMA has a lot of mortgages they can’t sell at a 10 percent discount. It has nothing to do with the insurance.

Mr. Simon: You think you could have gotten a premium at the same time without an FHA guaranty?

Mr. Trump: I don’t think I could have gotten the bank to go in on $15,000,000. That is the first thing.

Mr. Simon: What was the cost of Section 2?

Senator Lehman: Before you answer that, you gave the figure of three-million-six-hundred-and-some-odd-thousand dollars. Does that include the builders’ fee?

Mr. Trump: No, that doesn’t include the builders’ fee and it does not include a 5-percent architects’ fee. We took care of inspections for the architect and supervision for the architect.

Senator Lehman: Are you builders?

Mr. Trump: Yes.

Senator Lehman: If you hadn’t built this yourself, your corporation, would you have had to employ a builder?

Mr. Trump: Yes, we would have had to employ a builder.

Senator Lehman: What would you have had to pay them?

Mr. Trump: A builder might have charged anywhere from 7 to 10 percent to build the project, with much higher costs that what we paid also – construction costs.

Mr. Simon: What was the cost of section 2, Mr. Trump?

Mr. Trump: That is roughly 25 percent. If you multiplied that by 4 you would have the picture all the way through bet we have 6 sections which vary in size. This would give you the same picture multiplying it by 4.

The Chairman: What would the total be of the 4 projects?

Mr. Trump: Well, you multiply that by 4. The total mortgage was $16 million so the picture would be about the same.

The Chairman: How much was the difference between the mortgage proceeds and the actual cost on this first one? $600,000?

Mr. Trump: Is that exclusive of architects’ and builders’ fees?

The Chairman: That is right. Six-hundred-and-some-odd-thousand dollars? Then you multiply that by 4 and get $2,400,000? Is that the difference between the proceeds of the 4 mortgages and the actual cost that you received?

Mr. Tosti: About $2 million it would come out in round figures.

The Chairman: Something over $2 million?

Mr. Tosti: Pretty close.

Mr. Simon: I figure the difference between the mortgage proceeds and the total cost is $2,686,900.

Mr. Trump: You have $500,000 mortgage premium my associate tells me.

Mr. Simon: And I also allowed you an equal amount for FHA fees to earn the mortgage premium.

Mr. Trump: We still would have had to pay FHA fees if we got no premium on the mortgage or if we paid a point and a half penalty we would have had to pay the same FHA fees so that has no bearing on the amount of the mortgage premium.

The Chairman: Do you still own the property?

Mr. Trump: We own the property, yes.

The Chairman: Are you operating it?

Mr. Trump: Yes.

The Chairman: Is it successful at the moment?

Mr. Trump: It is highly successful.

The Chairman: Have you made money on the operation of it?

Mr. Trump: I wouldn’t know. We haven’t made operating profit and depreciation. We have amortized our payments, but there has been no operating profit.

The Chairman: What did you do with the difference of some $2 million between the actual cost of these four projects and the mortgage proceeds?

Mr. Trump: We have on hand about $3,500,000.

The Chairman: $2,600,000 coming from the mortgaging out and the other coming from operations?

Mr. Trump: Partial depreciation over three or four years.

The Chairman: But you have about $3,500,000 cash. Have you declared any dividends?

Mr. Trump: I don’t think we are getting it right. We also took in rents.

The Chairman: Have you declared any dividends?

Mr. Trump: No, we haven’t declared any dividends whatsoever and I haven’t draw a salary.

The Chairman: What do you do with the $3,500,000?

Mr. Trump: We have that in the bank at the present time.

The Chairman: Do you ever loan that to yourself?

Mr. Trump: I have loaned it to myself for periods not to exceed probably 90 days.

The Chairman: How much is the most you have borrowed at any one time from that fund?

Mr. Trump: Maybe $500,000 or $700,000.

The Chairman: Do you invest the balance in Government bonds or anything like that?

Mr. Trump: We had some invested. From time to time we invested it. I believe short-term notes or something like that.

Mr. Tosti: There is a tax problem involved in New York State that they wouldn’t know about. There is a local tax problem involved in investing money in a real-estate company in New York which you may not have in other States.

The Chairman: Why don’t you take that $3,500,000 and reduce the mortgage or at least take $2,500,000 and reduce the mortgage by that amount so that the Federal Government won’t have such a large liability?

Mr. Trump: It wouldn’t pay to do that, Senator.

The Chairman: Why wouldn’t it pay?

Mr. Trump: Could Mr. Tosti explain that? He is more familiar with it. It is an accounting procedure, and he is more familiar with it than I am.

The Chairman: Well, have you bought any mortgages with this $3,500,000?

Mr. Trump: Yes, we have made investments with approximately $500,000 of the mortgage payment.

The Chairman: That is in addition to the $3,500,000 you have on hand?

Mr. Trump: That is right.

The Chairman: You had $3,500,000 in cash?

Mr. Trump: That is right.

The Chairman: How much do you have in mortgages?

Mr. Judd: Mortgages and stock?

Mr. Trump: Mortgages and stock, about $500,000.

The Chairman: I would like to know why it wouldn’t be a nice thing to pay off $2 million or $3 million on the mortgage that the Government is the guarantor of-

Mr. Tosti: Senator, in the first place, under our project analysis we have a scale of rents. Up to this time we have been charging under the maximum scale of rents permissible by FHA. No. 2 It is a fallacy to think that reducing mortgages is an economic way of running a project.

The Chairman: Well, I am just thinking in terms of reducing it so the Federal Government would have less liability.

Mr. Trump: We feel the Federal Government has little or no liability in our project for various reasons: (1) Under the FHA directives which were handed down in 1947, if you will check back, I believe on January 2, they recommended the use of a declining balance method of depreciation for these projects and most people have used that. That means we depreciated 4½ percent roughly per annum. It also means that in 13 years the mortgages are going to be so far reduced that it is going to be economically not feasible to continue operating them and you are going to have to refinance them. These mortgages are going to be refinanced and FHA is going to be out of this picture in 14 years on our projects as they will on a number of others that have been continuously operated by the owner-builder. The money that we have in the bank and the reserve for replacement which we are piling up year after year, we may need as a cushion for a conventional loan at that time. In addition, you have to consider the individual owner such as Mr. Trump or any other builder, had a problem both in his estate if he should die, and for his own personal income tax, with mortgages that have been reduced, therefore it is almost impossible to get a purchaser to buy the project.

The Chairman: Have you paid any taxes on this $4,500,000?

Mr. Tosti: Not on the $4,500,000 left over out of mortgage proceeds. We are now gradually getting into the position where we are paying income tax, and so do all of these projects.

The Chairman: I am not saying this is your fault, particularly, but isn’t it a fact that when these mortgages are paid off – this FHA mortgage is paid off – $15 million worth of it.

Mr. Tosti: $16 million.

The Chairman: And you have about $4 million in cash and bonds on hand.

Mr. Tosti: That is right.

The Chairman: Mr. Trump’s children who this trust is left for, will have about $16 million worth of property plus cash, without ever having paid a nickel’s worth of tax? Now answer the question. Isn’t that true?

Mr. Tosti: No, they won’t get it because the leasehold has nothing to do with this project. And this leasehold has to continue for 200 years.

The Chairman: The children do not own the building?

Mr. Tosti: They don’t own the building at all.

The Chairman: They just own the land?

Mr. Tosti: They only own the land.

The Chairman: Who owns the building?

Mr. Tosti: The stock is owned by their trust –

The Chairman: How much capital was put in the corporation that owns this $16 million property?

Mr. Tosti: About $260,000 in capital stock.

The Chairman: Was that paid for in cash?

Mr. Tosti: Actual cash capital stock went in, and approximately $1,400,000 in cash loans from these people to the corporation to get the project running.

The Chairman: That has since been paid back out of the proceeds of the mortgage; is that correct?

Mr. Tosti: That is correct.

The Chairman: You did put $275,000 cash in?

Mr. Tosti: Right.

Senator Lehman: Who gets the rental?

Mr. Tosti: The rental goes to the six owning corporations, Senator. There are six corporations, they collect the rents and pay the bills.

Senator Lehman: It doesn’t go to the trust?

Mr. Tosti: No, sir, the trust has nothing to do with it.

Senator Lehman: What income do they get?

Mr. Tosti: They get $60,000 on the ground rent.

Senator Lehman: Then the ground rent goes into the trust?

Mr. Tosti: Just the ground rent, that is right.

The Chairman: The Beach Haven Management Corp. owns the building?

Mr. Tosti: There are six separate corporations and Management just operates the buildings.

The Chairman: When the mortgages are paid off they will own those properties without ever having paid any income tax?

Mr. Tosti: No, not necessarily. As a matter of fact, if you check back at the original pamphlets that were issued, they recommended we use this theory in order to protect the mortgagee – this high depreciation – because they wanted the builders to recoup as quickly as possible, their investments in the projects.

The Chairman: We are checking into that but I think under the rules and regulations of FHA, the statement I made is true, isn’t it? We are not blaming you gentlemen for some of these things. Maybe we ought to start out all our hearings here with the statement – what is it they use on Meet the Press, that the questions we are asking here don’t necessarily –

Mr. Tosti: Reflect the opinions of the committee?

The Chairman: Our problem here is to find out what has been going on and what is going on.

Mr. Tosti: After about 5 years, regardless of – I mean because of declining balance depreciation, if these projects are rented up to approximately 95 percent they are going to pay income tax. There is no way they can avoid paying income tax. They will start paying it. We are paying it now. It isn’t heavy yet but it will gradually get heavy as we go along.

The Chairman: I hand you a letter. Did you get this letter out, Mr. Trump, and if so, to whom? Read what the headline says.

Mr. Trump (reading): “July 29, 1954. Dear Tenant – ” Now this letter was gotten out.

The Chairman: Read the headline. What does it say?

Mr. Trump: This letter was gotten out the day after a tenant committee was formed due to these misleading headlines in all the newspapers.

The Chairman: What does that say in that letter?

Senator Lehman: What is the date?

Mr. Trump: July 29, 1954.

The Chairman: What does it say, Washington, what?

Mr. Trump (reading): “Washington headline hunters-”

Senator Lehman: What is the date?

Mr. Trump: The letter was dated wrong, Senator. It was June 29.

The Chairman: What is the headline?

Mr. Trump (reading): “Dear Tenant: Washington headline hunters have been circulating false and misleading stories concerning Beach Haven at Brighton. Our advice is, keep cool and pay no money to anyone.” Now here is the letter.

The Chairman: The reason for that was they were organizing a committee to get the rents reduced.

Mr. Trump: That is right.

Mr. Judd: And in the tenants’ letter they were citing headlines which had come from a release issued in Washington.

The Chairman: Who were the headline hunters?

Mr. Judd: I don’t think we tried to identify them.

Mr. Trump: It is not this committee. I will go on record saying it, Senator. Here is the headline. Let me just read this. This is the front page of a highly respected Brooklyn newspaper.

The Chairman: The Brooklyn Eagle?

Mr. Trump (reading): “Charge $4 million Windfall to Builder of Beach Haven. Federal investigators -” this is United Press, Washington.

The Chairman: And what should the amount have been?

Mr. Tosti: We question the wording in here.

The Chairman: You weren’t questioning the amount?

Mr. Tosti: Some words that were used.

Mr. Trump (reading): “Federal investigators checking the housing loan scandals have accused Fred C. Trump, Jamaica, Long Island, builder of pocketing $4,047,000 windfall on the Beach Haven Apartments in Brooklyn.” That means I drew it out and put it in my pocket and I have never drawn a salary the 3 years that Beach Haven has been operating.

The Chairman: You didn’t draw it out, it is still in the bank. They were wrong?

Mr. Trump: But we owe $16 million, Senator. In other words, we have the real estate and we have the cash in the bank and on the other side we have a liability of $16 million which has since been paid off, approximately $1 million. This is, I believe, very wrong and it hurts me. The only thing I am happy about is that it is not true.

Senator Lehman: Well, Mr. Trump, without going into the merits or the justification for your having this so-called windfall of $4 million, isn’t it a fact that $4 million, while not paid out to you in the form of a windfall, is in the treasury of the company and could be paid out, at any time? So it is not so very inaccurate as to the amount of the windfall.

Mr. Trump: I first have to take it out before I pocket it, Senator; isn’t that right? I am happy we haven’t taken it out.

The Chairman: Who is the president of these six corporations?

Mr. Trump: I am.

The Chairman: Who owns the controlling stock?

Mr. Trump: I do; 75 percent.

The Chairman: Who owns the other 25 percent?

Mr. Trump: William Tomasello.

The Chairman: Who is he?

Mr. Trump: A building contractor.

The Chairman: You two together, you 75 and he 25, own the $4 million?

Mr. Trump: Yes.

Mr. Simon: In the application you filed with FHA you listed architects’ fees as exactly 5 percent; is that right?

Mr. Trump: I think so; yes.

Mr. Simon: Is that true of all the applications?

Mr. Trump: Yes; that was an FHA application.

Mr. Simon: Who was the architect?

Mr. Trump: Seelig & Finkelstein.

Mr. Simon: How much were they paid for architectural services?

Mr. Trump: I would say a little under 1 percent, probably.

Mr. Simon: When did you contract with them to furnish these architectural services?

Mr. Trump: Prior to the construction of the job.

Mr. Simon: At the time you filed this application and said the architects’ fee was estimated at 5 percent, did you know it was going to be less than 1 percent?

Mr. Trump: I didn’t know it at the time. They didn’t know what they would run into, but I believe the FHA – the 5 percent was the FHA regulation. In other words, they give you help in filling out an application and they put for architects’ and builders’ fees 5 percent.

The Chairman: Would you have built these buildings had you known you were going to get credit only for the actual amount spent for architects, 1 percent instead of 5, perhaps?

Mr. Trump: Yes.

The Chairman: Would you have built the buildings had you known you weren’t going to get the 5 percent builders’ fee?

Mr. Trump: There, I would heistate.

The Chairman: In other words, would you have built these buildings had you known that you were going to have to put any money in them of your own?

Mr. Trump: We were prepared to put money in Senator. I signed a personal indemnity agreement which meant every dime that I owned in this world, and with a rising market of 8 percent, I would have been wiped out of what I built up over the past 27 years in the building business.

Mr. Simon: When did you enter into your architectural agreement contract with Seelig & Finkelstein?

Mr. Trump: I don’t have the date, Mr. Simon, but it is prior to the construction of the job. They had to prepare the plans.

Mr. Simon: And they had to prepare the plans prior to the FHA application, didn’t they?

Mr. Trump: They prepared sketches, with the application.

Mr. Simon: Didn’t you have some agreement with them as to the fees when they prepared the sketches?

Mr. Trump: They prepare on a lot of projects that never go through. They never get built. For me, as well as other builder. It is more less elastic.

Mr. Simon: Do you know of any $16 million project of this kind in which the architect has received a fee anywhere near 5 percent?

Mr. Trump: I think that is the standard fee, 5 percent, except the FHA owner-buliders, who are a new breed of low-cost builders just being discovered now. They pay less than 5, but I think in the trade, 5 percent is the standard architects’ fee.

Mr. Simon: Do you know of any $16 million multihousing project of this kind in which the architect gets 5 percent?

Mr. Trump: I would imagine all public housing pays 5 percent. All State housing pays 5 percent.

Mr. Simon: Do you know of any privately constructed housing?

Mr. Trump: That I wouldn’t know, Mr. Simon. I only know of my own; that is all I know.

Mr. Simon: Do you know of any?

Mr. Trump: No, I don’t know of any fees at all except my own.

Mr. Simon: When you filed this application did you contemplate you would have to pay as much as 5 percent for architects’ fees?

Mr. Trump: That was in 1949. I really don’t know what I contemplated. I assume that is what FHA allowed by the regulations and that was the standard architects’ fee if you call the society.

Mr. Simon: You paid the architect less than 1 percent?

Mr. Trump: The 5 percent, Mr. Simon, covered supervision which was required by FHA, which we performed for the architect.

Mr. Simon: You paid him less than 1 percent; is that right?

Mr. Trump: Yes.

Mr. Simon: Now, at the precise time you filed this application, what did you think you think you were going to have to pay the architect?

Mr. Trump: When we made the deal that we would take care of the detailed supervision of the project, I don’t know just what the date was.

Mr. Simon: When you filed this application, what did you contemplate the architects’ fee would be?

Mr. Trump: Mr. Tosti tells me the FHA regulation called for 5 percent architects’ fee.

Mr. Simon: Could you get us a coy of that regulation?

Mr. Trump: I really don’t know. I really don’t know.

Mr. Simon: Have you ever seen it?

Mr. Trump: It is my recollection if anyone needed assistance with FHA applications and they went to FHA, they would fill out a form and fill in architects’ fee and builders’ fee, knowing that they are necessary costs, whether you perform them yourself or not. They must be performed. Otherwise you wouldn’t have a building.

Mr. Simon: Have you ever seen an FHA regulation that says architects’ fees were to be 5 percent?

Mr. Trump: I don’t recall, but I will say this: FHA has processed every application –

The Chairman: There isn’t any question about that. There is no question about that.

Mr. Trump: And it is provided by the regulations.

Mr. Simon: What is provided by the regulations?

Mr. Trump: The 5 percent architects’ fee.

Mr. Simon: Have you ever seen a regulation that says that?

Mr. Trump: No, I am a builder.

Mr. SImon: Then, how do you know these regulations provide for a 5 percent architects’ fee?

Mr. Trump: They wouldn’t have allowed it if they didn’t.

The Chairman: There is nothing in the law, nothing in the regulations that we can find that talks about 5 percent. We are trying to find out who it was with FHA that arrived at this idea. In all our executive sessions – and we have listened to a lot of people – we haven’t found one yet that used the 5 percent. Most of them were less than 1 percent or one-half of one percent, and in most cases they were their own builders so they didn’t have any 5 percent fees. What it looks like is that there was a windfall here of about 8 percent on most of these projects, just through architects’ fees and builders’ fees. And on $7 billion worth of this sort of thing, 8 percent of $7 billion woul dbe what, $560 million.

Mr. Tosti: You are talking about the home program?

The Chairman: Just on those two things alone.

Mr. Tosti: The application would probably come within the scope of the Chief Underwriter. The Chief Underwriter probably laid out to his assistants how these applications were to be made up. When these applications were prepared by builders or by mortgage brokers, whoever prepared them, they were told to take 5 percent architects’ fees and 5 percent builders’ fee.

Mr. Simon: Who told you that?

Mr. Tosti: If you went into FHA and asked anybody in FHA to help you prepare an application, or if you would call them on the phone and say, “Look, what am I supposed to put down for architects’ fee,” they would say, “Put down 5 percent.”

The Chairman: They would tell you that?

Mr. Tosti: They would tell you that on the telephone.

The Chairman: Regardless of what it might cost you?

Mr. Tosti: Yes. They would tell you right on the telephone. “Put down 5 percent.”

Mr. Simon: If you had an architect and you had an agreement to do it at 2 percent, why bother to call anybody, why not put in the 2 percent?

Mr. Tosti: Because this is based on an estimated current cost and that is the formula under which FHA worked.

Mr. SImon: Can you give us anything in writing that says that?

Mr. Tosti: Of course I can’t. I don’t work for FHA. I called them many times and got information from them. The same as they put down, “legal fees, $8,000.” The fellow in FHA didn’t like it, he would change it to 6, change it to 7, do it anyway he wanted to.

Mr. Simon: That is a different story.

Mr. Tosti: What is the difference?

Mr. Simon: FHA made their own analysis but your application was something that you filled out, wasn’t it?

Mr. Tosti: Mr. Simon, the only thing that a builder, in signing one of tehse applicatoins was interested in or that he was submitting was one thing only. It is right at the head of the first page. He was building a project consisting of 391 apartments and he wanted $8,100 per apartment for it.

Mr. Simon: That is the maximum for all that?

Mr. Tosti: That is his application. That is as much as he knew.

Mr. Simon: In other words, you are saying all he cared about was whether he warranted a mortgage for the maximum the law allowed. Is that right?

Mr. Tosti: That is right, if he was entitled to it.

Mr. Simon: And he didn’t care at all about all the other information on pages 2, 3 and 4?

Mr. Tosti: When this application is submitted, there is submitted a plan, if you will look down here. A room plan. There is no final plan of 75 pages. What builder would know what this construction figure actually was supposed to be? He hasn’t seen a plan on it yet. He has seen only a plot plan of a room size without a finished plan. He doesn’t know whether it is tile, he doesn’t know whether it is concrete floors, I don’t know whether it is casement, or anything else.

Mr. Simon: Then you think the estimates in the application, except other than the request for the maximum, were all meaningless, is that right?

Mr. Tosti: Not completely meaningless. It was probably our best estimate of what the total would be.

Mr. Trump: The big problem is, when you file with FHA it takes from 6 months to a year to get a commitment. Now, no one knows what is going to happen in that 6 months to a year. I would say 6 months is a very, very short time. We don’t know what we are up against. On our Beach Haven project we gave out contracts for 6,500,000 feet of lumber, during that very short recess just prior to Korea, at $70 a thousand. Six months later, one of the lumber yards couldn’t deliver a portion of their contract and we had to pay $110 to anther lumber yard to complete that first contract that was given out 6 months prior at $70. That is an increase in lumber over a 6 months period, of 60 percent. There is approximately 8 or 9 or 10 million dollars worth of material in this Beach Haven. 60 percent would be close to $6 million which would put any building in bankruptcy. Now, where an architects’ fee might have been a little high, maybe they were wrong on tile. We don’t know what the market is. We hear concrete goes up $1 a thousand. Nobody says that is $180,000 on the job but a dollar a yard is $180,000 on a job like that.

Senator Payne: Mr. Trump can I ask you this? At any time following the construction of the project, did anybody ever come out and contact you to see what your actual costs of construction were?

Mr. Trump: I don’t think so, no. I don’t remember, no.

Senator Payne: In the figures of costs of construction that you gave just a few minutes ago to Mr. Simon, or several minutes ago, was there included in that cost of construction, maintenance of your office, builders’ offices as such and expenses such as that?

Mr. Trump: Our offices are very meager. It was built right on the project as part of the storage sheds, you might say.

Senator Payne: I mean you had certain expenses in that connection, didn’t you?

Mr. Trump: Our overhead was cut down very low.

Senator Payne: What I am getting at, the ordinary contractor –

Mr. Trump: They go in for classy offices, but we don’t have that.

Senator Payne: The cost of those operations were included?

Mr. Trump: Yes, but it is just an office to get out of the rain, that is about all.

Senator Payne: But all of the paperwork and everything else in that connection was likewise charged to the project?

Mr. Trump: To give you an idea –

The Chairman: You have a big general office somewhere?

Mr. Trump: Yes.

The Chairman: Where did you buy all the material?

Mr. Trump: Right from the project.

The Chairman: From this little house you are talking about?

Mr. Trump: Yes.

Senator Payne: And that material was charged to the project at cost?

Mr. Trump: That is right.

The Chairman: And you kept records of all that?

Mr. Trump: Yes.

Mr. Judd: Senator Payne asked, “at cost?”

Mr. Trump: At cost, yes.

Mr. Simon: All the supervisory help you had was charged to the project?

Mr. Trump: That is right, yes.

The Chairman: Had there been a law in effect at the time requiring that when you finished this project you could only get 90 percent of the actual cost of construction, would you have built these projects?

Mr. Trump: No. Do you mean to invest 10 percent? You couldn’t do it. That would only be a paper loss, which could not mean anything.

The Chairman: Just wouldn’t do it?

Mr. Trump: You couldn’t do it.

The Chairman: In other words, unless you could get your money out – at least get your money out – you wouldn’t do it? Do you think that is true of other builders?

Mr. Trump: Senator, you couldn’t do it. There is a difference of probably 40 percent between general contractors who are general contractors, with elaborate offices and who do important work, or us penny-ante FHA builders. There is a difference of 40 percent in cost figures. Now, when you say 90 percent, well how are some of these expensive fellows going to work out? They would be putting 30 percent in it over the loss. Every builder builds at a different cost. There is no such thing as one cost. Some builders are more efficient than others, some have a better credit rating, and so on.

The Chairman: You just wouldn’t have built these buildings if you had to put any of your own money in them?

Mr. Trump: Well, I don’t say any. All the money that I have and that I can borrow.

The Chairman: I am talking about capital investment now. In other words, under the law, what Congress thought they were doing – or at least what I think they thought they were doing – this cost $16 million. Congress thought you were going to put $1,600,000 in it.

Mr. Trump: We had $1,900,000 invested in this project.

The Chairman: That was a loan?

Mr. Trump: Well, it was in there at the time of the critical stage.

The Chairman: I am talking about $1,600,000 worth of capital stock. If you had to put $1,600,000 worth of capital stock, which is 10 percent of the amount of this mortgage, would you have built the 6 buildings?

Mr. Trump: Now would you include a builders’ fee for us or not?

The Chairman: 90 percent of your actual costs.

Mr. Trump: We couldn’t do it. If we had a rising market we would be right out of business on the first job.

The Chairman: Not at 90 percent of actual cost?

Mr. Trump: Yes, because costs go up while you are waiting for the FHA.

The Chairman: It would still only be 90 percent because you are going to certify when the building is finished.

Mr. Tosti: Your mortgage is static. That doesn’t go up.

The Chairman: I am saying had the law been on the basis that you were to get 90 percent of your actual cost, would you then have built it?

Mr. Trump: No.

The Chairman: Are there any other questions, Senator Payne?

Senator Payne: I have no questions.

The Chairman: Thank you very much.

Mr. Judd: Senator, we have a statement. I

(Senate Banking Committee FHA Investigation, July 12, 1954)