Donald Trump’s former “attorney,” Michael Cohen, was recently the subject of a blistering sentencing memorandum from federal prosecutors, that claimed “the crimes committed by Cohen were more serious than [he admits] and were marked by a pattern of deception that permeated his professional life.”

Before Cohen graduated from one of America’s worst law schools, his professional life included earning millions of dollars from taxi medallions that were managed by Evgeny Friedman, an confessed felon who has been a cooperating witness against Cohen in a bid to reduce his own jail time.

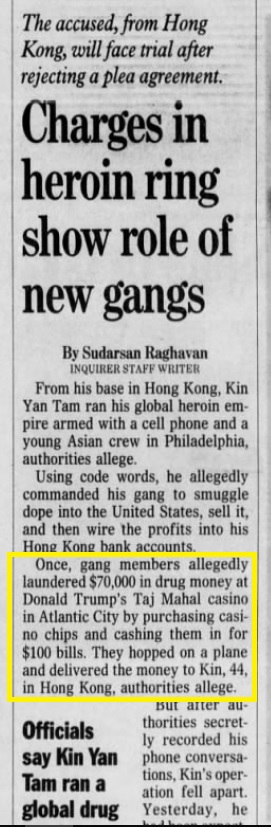

Michael Cohen once owned part of a floating casino that would take passengers three miles off the coast of Florida, into international waters where they were outside the jurisdiction of U.S. law. The business ultimately collapsed, leaving behind dozens of lawsuits relating to unpaid bills, paychecks and liabilities to injured customers.

Michael Cohen owned a share of El Caribe Country Club, a social club that served as the headquarters for the Russian mafia in New York under two crime lords.

RAGEPATH suspects we still have much to learn from federal prosecutors about the shady business dealings of Michael Cohen.