Trump received a suspiciously generous mortgage from Hong Kong investors in July of 1994 that saved his troubled Riverside South development from bank foreclosure. The exact same month, Trump’s brother Robert used companies that Donald partially owns, to invest millions of dollars in a family of overseas companies that would be defunct within three years. Was Trump paying overseas investors to lend him money?

Trump lived off one-time cash infusions

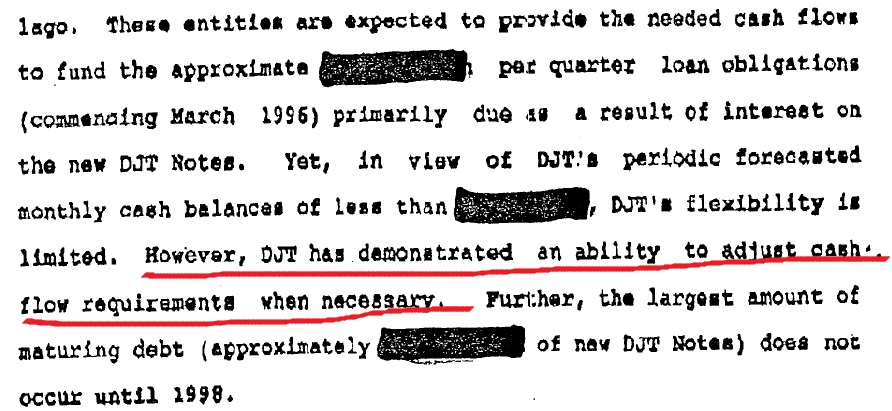

One of the strangest observations about Donald Trump’s cash flow comes from a 1995 analysis by New Jersey casino regulators. The report noted that all Trump’s significant sources of cash flow “appear to be one-time occurrences and do not represent continuing sources of funds.” The report also noted that Trump’s cash flow problems were likely to grow in the future, because the end of a 1990 agreement with his lenders meant “debt service on the replacement debt must now be serviced with cash.” Despite finding Trump’s cash flow had underperformed projections, his major potential income streams were heavily leveraged, and his projected cash requirements were likely to only grow, regulators opined that he would be solvent enough to continue operating his casinos because he had “demonstrated an ability to adjust cash-flow requirements when necessary.”

Right there, in a nutshell, is the problem of Donald Trump’s finances. They don’t make sense. He’ll spend millions of dollars on enterprises that lose money, but somehow there’s always cash around when he needs it.

That explains why a growing number of observers have reached the conclusion that Trump is engaged in some kind of money laundering operation. It would appear that Trump controls some level of assets held entirely “off the books.” When he needs cash in America, he pays a foreign intermediary to loan it to him.

Trump bailed out by generous Hong Kong lenders

The starkest example of this can be seen in 1994. During this period, Donald Trump was still laboring under an Operating Agreement he had reached with his banks after bankrupting several companies he controlled and defaulting on billions of dollars in loans. Trump had maintained control over Riverside South, a large parcel of undeveloped rail yards that Trump and his father had been trying to develop since the early 70s. The property, which yielded no income, was also heavily mortgaged.

By summer 1994 it looked like Trump would be forced to default on the loans and surrender the property to his bankers. Suddenly, a mysterious group of Hong Kong investors swooped in to buy up Trump’s distressed $210 million mortgage at a steep discount of only $90 million. The new investors gave Trump generous terms, allowing him to keep 30% equity, operational control, and an open line of credit to finance development.

They seemed to come out of nowhere — a powerful group of Hong Kong billionaires who appeared in June to revive Donald J. Trump’s troubled Riverside South project with millions in cash and a promise to finance the multibillion-dollar development. […] The $2.5 billion project had been languishing until the arrival of the Hong Kong investors, who purchased Mr. Trump’s $250 million debt on the land for $90 million and made a commitment to finance the construction of Riverside South. (New York Times, August 29, 1994)

Trump’s Brother Sent Millions Abroad, No Return

Why would RAGEPATH think that this $90 million from Hong Kong was actually Trump’s money? Well our suspicions start with a publicly-traded company called Management Technologies that spent $12.8 million to buy four companies called “Winter Partners” based in New York, London, Singapore and Hong Kong from someone in Zurich.

On July 14, 1994, the Company acquired Winter Partners Limited, Winter Partners, Inc, (subsequently renamed MTi Abraxsys Systems, Inc), Winter Partners Pte Limited (subsequently renamed MTi Abraxsys Systems Pte Limited), and Winter Partners (HK) Limited (subsequently renamed MTi Abraxsys Systems (HK) Limited) from Winter Partners Holding AG. The companies, hereafter referred to as the WP companies, formed the international banking software division of Winter Partners, a Zurich, Switzerland based company. The Company paid a total of $12,800 for the WP companies. The Company financed the acquisition through a combination of cash from its own resources, short term borrowings and proceeds from new share issuances. (Management Technologies, Annual Report, Fiscal Year 1995)

Item 12. Certain Relationships and Related Transactions [...] Robert S. Trump, Gerald Franz, Midland & Associates [...] the Company also agreed to place the sum of $100,000 in an escrow account with its counsel for the specific purpose of repayment of the $50,000 loan made by Mr. Franz and for payment by the Company under a joint marketing agreement with Financial Performance Corp., a software company of which both Messrs. Franz and Trump are affiliates. The funds in the escrow account have been disbursed as determined by Mr. Franz, in his sole discretion, including a $40,222.15 payment made to Mr. Franz. [...] As a consequence of a transaction with Midland Associates, a general partnership in which Mr. Trump is a partner, in July of 1994, the Company entered into a financial consulting agreement with Mr. Gerald Franz to perform financial consulting services, and agreed to pay Mr. Franz or his designee a fee in the sum of $60,000. (Management Technologies, Annual Report, Fiscal Year 1995)

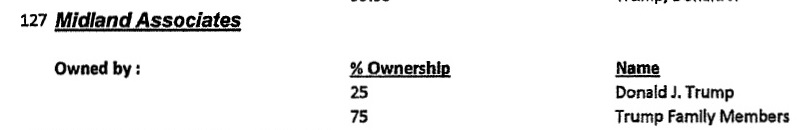

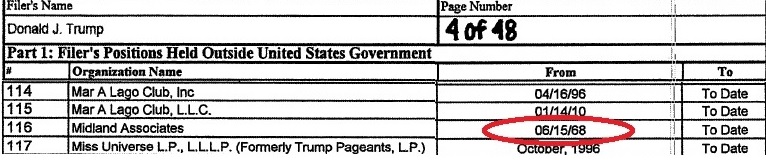

We know from Donald Trump’s 2015 Financial Disclosure that he was a 25% owner of Midland Associates at the outset of his presidential campaign. The remainder of the company was owned by Trump’s family members.

We also know from Trump’s 2015 Financial Disclosure that he had been a partner in Midland Associates continuously from 1968. This would mean that Donald Trump owned at least 1/4 of the money that was pumped into Winter Partners through Midland Associates.

Winter Partners was acquired in July of 1994 in an acquisition transaction that included Abraxsys, Inc., Abraxsys Pte and Abraxsys HK. The Company paid a total of $12,800,000, and incurred certain additional costs of approximately $325,000. [...] In the years ended April 30, 1995, 1996 and 1997, Winter Partners incurred losses of $5,038,147, $6,070,311 and $1,954,026, respectively. No dividend was paid to Management Technologies, Inc. in conjunction with the liquidation of Winter Partners. Accordingly, at April 30, 1997, the Company's apportioned investment in, and advances to, Winter Partners are valued at zero. (Management Technologies, Annual Report, Fiscal Year 1997)

So what’s the deal here? Is this a staggeringly stupid investment by Donald Trump’s brother, who purchased several foreign-controlled companies with one company, then loaned them an undisclosed sum secured against all their future earnings with another company, only to lose his entire investment?

Or is it a simple payment to someone overseas that may have financed the loan Donald Trump received in the exact same month these payments were made?